An Income Tax Return (ITR) is a document that allows a person to declare their income, expenses, tax deductions, investments, and taxes. It requires taxpayers to file an income tax return in several situations. However, there may be other reasons to file an income tax return even if you do not have the requisite income, such as carrying forward losses, claiming any income tax refund, applying for a VISA, a bank loan, term insurance, etc.

E-filing is submitting an Income Tax Return (ITR) electronically using the Internet. People may use an identity-based username and password to access the new income tax site, which has features that make the tax filing process more accessible.

Why is Income Tax Return Filing Essential in Dubai, UAE?

Even if an individual's income does not meet the requirements for mandatory ITR filing, it is always intelligent to file on your own to keep all of your past paperwork. There can be various advantages to having your ITR in place, such as giving proof of income when applying for a visa or taking out a loan when traveling to a foreign destination.

Here are seven corporate auditing tips to help you conduct a thorough and effective company audit:

- I need a refund.

- If you have a loss that you need to carry over, please submit it to any authority or financial institution.

- To avoid any penalties from the income tax department and to comply with tax laws.

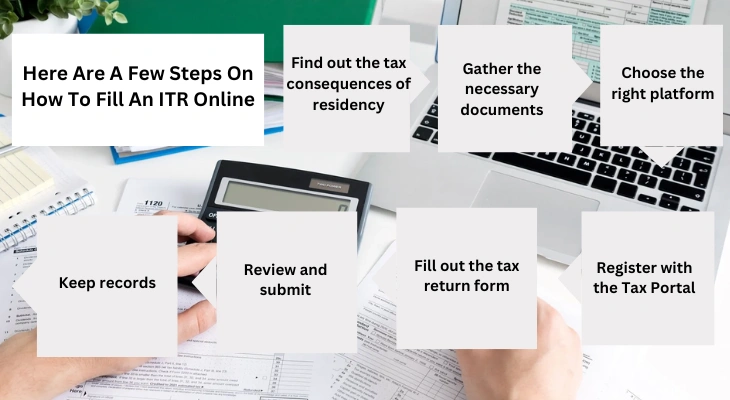

Here are a few steps on how to fill an ITR online

1. Find out the tax consequences of residency

The UAE has no personal income tax. However, if you have income from other countries or were a taxpayer living across another nation, you may be required to submit a tax return there.

2. Gather the necessary documents

- Collect all essential documentation, including:

- Income Statements (Salary Slips, Business Income)

- Passport and Visa Copies

- Bank Statements

- Investment Income Documents

- Any tax files from your home country

- Other Relevant Documents

3. Choose the right platform

- If you must file in another jurisdiction (such as your home country), visit the official tax authority website.

- Foreign citizens in the UAE should visit their home country's tax authorities at designated filing venues.

4. Register with the Tax Portal

Open an account on the tax authority's website. This often includes providing your personal information, including your tax identification number.

5. Fill out the tax return form

Complete the relevant papers with the correct income and spending information as instructed by our tax consultant.

Check to see if you are eligible for any deductions or credits. (Our professionals will help you to check for any deductions or credits)

6. Review and submit

- Make sure your information is correct.

- Submit your tax return.

7. Keep records

After submitting the return, save a copy & any official letters for future keeping.

If your situation is complicated, consider speaking with our tax specialist in Dubai, UAE who is experienced with foreign tax legislation.

Top Advantages of Filing Income Tax Returns for 2024 - 2025

- Ensure conformity with Income Tax Authorities by submitting timely returns and declaring oneself a Genuine, Responsible, and Proud Citizen.

- Increase your chances of acquiring a loan, particularly for a house or personal loan.

- Reduces the likelihood of receiving legal notices if one files returns every year.

- There is no reason to fear, especially if you are an NRI returning to your home nation permanently after retirement.

Bonus Tips

- Filing deadlines: Be careful about the native country's filing deadlines.

- Stay informed: Tax rules might change, so stay current on any restrictions affecting you.

If you want further information on Income Tax Return (ITR) in Dubai, Lotus Touch Accounting provides highly qualified and experienced Tax advisors in UAE that assist customers with the best Income Tax Return services in UAE, assuring compliance with the Revenue and Taxation Authority's rules and regulations.

Our experts will help you with document preparation, determining tax due, and tax compliance for tax activities such as registration, filing returns, and refunds.

Do you need assistance with submitting your income tax return? Contact Lotus Touch Accounting if you have any questions.